A Clear Guide to the IRS Time Limit for Collecting Taxes

Learn how the IRS Collection Statute Expiration Date (CSED) limits the time the IRS can collect tax debt, what events extend it, and how taxpayers can protect their rights.

Understanding the IRS Collection Statute Expiration Date (CSED)

The IRS Collection Statute Expiration Date (CSED) is a critical component of federal tax law because it determines how long the IRS can legally collect a tax debt. Whether you owe back taxes, are considering an Offer in Compromise, or want clarity about your rights as a taxpayer, understanding the CSED helps you make informed decisions and avoid unnecessary financial stress.

What Is the IRS Collection Statute Expiration Date?

The Collection Statute Expiration Date (CSED) is the legal deadline for the IRS to collect an assessed tax debt. In most cases, the IRS has 10 years from the date of assessment to collect.

Key points:

- The 10-year period begins when the tax is officially assessed, not when it is filed.

- Once the CSED expires, the IRS can no longer pursue enforced collection actions, such as levies or garnishments.

- Many taxpayer actions such as installment agreements, bankruptcies, or appeals can pause (suspend) or extend that 10-year period.

Understanding your CSED protects you from overpayment, ensures IRS accountability, and can influence your tax resolution strategy.

Types of Tax Assessments That Establish Their Own CSED

Each type of IRS tax assessment starts its own unique 10-year CSED period. Common assessments include:

1. Original Tax Returns

Taxes assessed from voluntarily filed returns begin the standard 10-year collection window.

2. Amended Returns

If you file an amended return and additional tax is assessed, a separate CSED applies.

3. Substitute for Return (SFR)

When a taxpayer does not file a tax return, the IRS may file an SFR. The assessment from an SFR also initiates a CSED.

4. Audit Assessments

If an IRS audit results in additional tax owed, that new assessment has its own 10-year CSED.

5. Certain Penalty Assessments

Penalties (e.g., failure-to-pay, accuracy-related penalties) may also create separate CSED timelines.

Because multiple assessments can occur in the same year, a taxpayer may have several CSED dates on their IRS account transcript.

What Is the IRS Collection Statute Expiration Date?

How the IRS Collection Period Can Be Suspended or Extended

The IRS collection period does not always run continuously for the full 10 years. It can be suspended or legally extended, depending on taxpayer actions or legal restrictions.

1. Difference Between Suspension and Extension

| Term | Meaning | Can the IRS? |

| Suspension | The 10-year clock is paused due to legal restrictions. Time is added back later. | No |

| Extension | The law adds specific extra time beyond the original 10 years. | Yes |

Suspension and extension both delay the CSED, but suspension occurs because IRS collection is prohibited during that time, whereas extension is an automatic legal addition.

2 Overlapping events and combined impact

If multiple suspension events occur at the same time (e.g., bankruptcy and an Offer in Compromise), the IRS does not double-count overlapping periods.

Instead, suspension timelines run simultaneously.

Common Events That Suspend or Extend the CSED

Below are the most common taxpayer actions that impact the IRS collection period.

1. Requesting an Installment Agreement (IA)

When you request an Installment Agreement, the IRS suspends the CSED for:

- The time the IA request is under consideration

- 30 days after an IA rejection

- 30 days after the IRS proposes terminating an existing IA

- The entire period of any appeal (rejection or termination)

This suspension period prevents forced collection while the request is reviewed.

2. Filing for Bankruptcy

Bankruptcy significantly affects CSED:

- The CSED is suspended from the bankruptcy filing date until the case is dismissed, closed, or discharged.

- After the bankruptcy ends, the CSED is extended by an additional 6 months.

IRS collection is legally restricted during an active bankruptcy, which is why the time is paused.

3. Submitting an Offer in Compromise (OIC)

When an OIC is submitted:

- The CSED is suspended while the offer is pending.

- If the IRS rejects the offer, the CSED is suspended for 30 more days.

- If you appeal the rejection, the suspension lasts throughout the appeal period.

This ensures taxpayers are not penalized for using their right to seek tax relief.

Common Events That Suspend or Extend the CSED

4. Requesting a Collection Due Process (CDP) Hearing

When filing a CDP request, the CSED is suspended from:

- The date the IRS receives the request

- Until the CDP determination becomes final (including court appeals)

If fewer than 90 days remain when the decision is final, the IRS receives an automatic extension to 90 days from that date.

5. Filing an Innocent Spouse Claim

Innocent Spouse Relief suspends the requesting spouse’s CSED:

- Suspension lasts from the filing of the claim

- Until a waiver is signed, the 90-day Tax Court petition window expires, or the Tax Court decision becomes final

- If the case goes to Tax Court, the CSED is extended an additional 60 days

This protects spouses seeking relief from joint liabilities.

What Happens When the IRS Collection Period Expires?

Once the CSED expires:

- The IRS cannot legally begin or continue enforced collection actions for that tax year.

- Any tax balance becomes unenforceable.

- If the IRS issued a levy on a fixed future income stream (e.g., Social Security), and the levy was made before the CSED expired, the IRS may continue collecting from that levy.

This is why understanding your CSED is essential so you don’t overpay or face unlawful collection efforts.

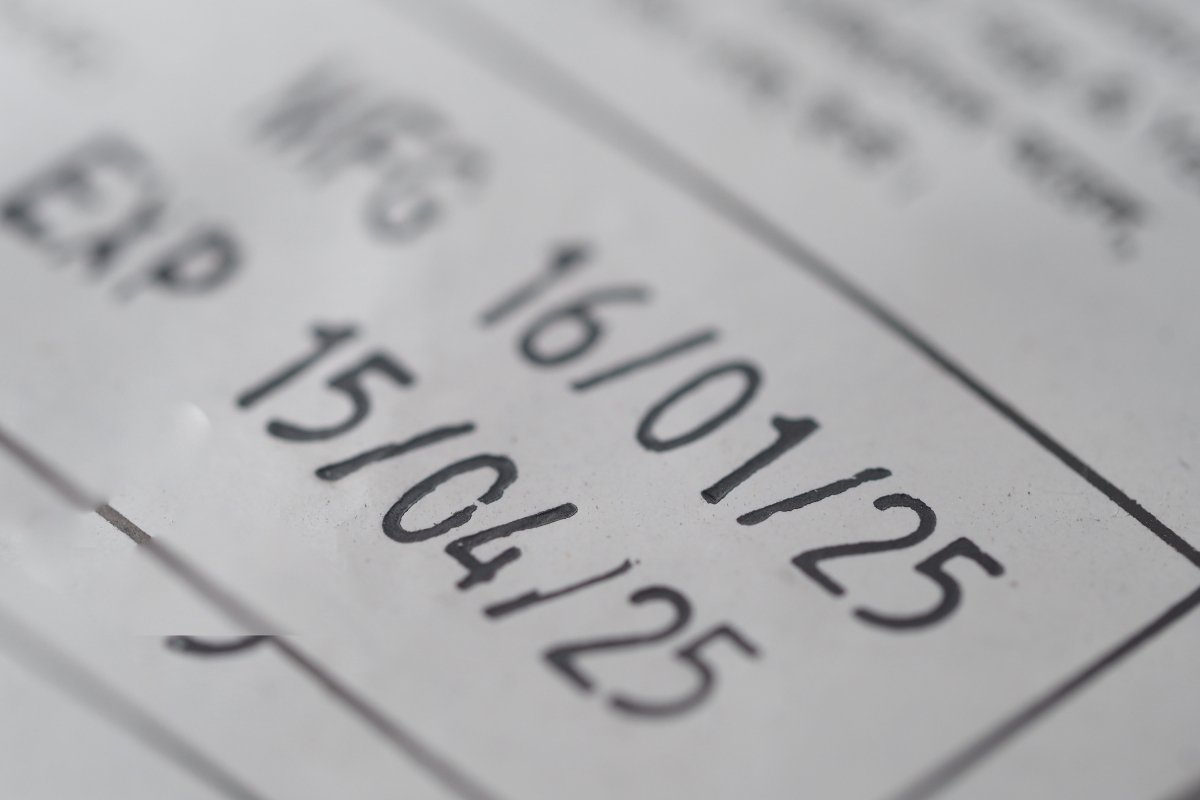

How to Check Your CSED

You can verify your CSED through:

- IRS Online Account: Shows transcripts and earliest CSED for each tax year.

- Form 4506-T: Request transcripts by mail.

- Calling the IRS: You can call 800-829-1040 to request a breakdown of how your CSED was calculated.

Account transcripts display each “assessment” and all suspension periods affecting your CSED.

What to Do if You Disagree With a CSED Calculation

If you believe the IRS miscalculated your CSED:

- Contact the IRS and request a CSED review.

- If the explanation is unclear or incorrect, contact the Taxpayer Advocate Service (TAS).

- File Form 911 to request TAS assistance.

The IRS does make errors, especially when multiple assessments and suspensions overlap, so reviewing your CSED is important.

How to Check Your CSED

What If You Made Payments After the CSED Expired?

If you voluntarily paid or the IRS collected money after your CSED expired, you may be eligible for a refund.

Steps:

- Contact the IRS to request your refund.

- Submit the request before the Refund Statute Expiration Date (RSED).

- The IRS may notify you of post-CSED payments via Letter 672C.

Knowing your CSED helps you avoid paying money you no longer legally owe.

Conclusion

Understanding the IRS Collection Statute Expiration Date (CSED) is a vital part of managing tax debt and protecting your rights. The 10-year collection period can be suspended or extended for many reasons, and keeping track of these events ensures that you remain informed, compliant, and financially secure.